Why outsource payroll?

It’s national payroll week! Taking place on the 7th-11th September, National Payroll Week was established to raise the profile and awareness of payroll in the UK.

National payroll week is an opportunity to celebrate payroll professionals and of course as we are Xero payroll certified and offer payroll as a bolt service we can’t miss this chance to polish our own shiny halos. 😇

So why outsource payroll?

Expertise

Every year payroll legislation changes, the minimum wage is updated, automatic enrolment for pensions has been changing over recent years, statutory payments change.

Add in statutory sick pay, maternity pay, paternity pay, shared parental pay and this year furlough and it quickly becomes obvious why you need someone who knows what they are doing keeping your business on the right side of payroll legislation.

This plus the use of good software will ensure that you are staying on the right side of HMRC, month in month out.

Error rates are decreased

In many organisations payroll is the largest expenditure, people are the key to running the show. Although pay isn’t the only thing that motivates employees, getting payroll wrong can definitely act as a demotivator.

By outsourcing your payroll the risk of payroll errors is decreased because you have a team of specialists who are focused on payroll. The distraction of trying to do payroll alongside all of the other roles you are juggling in running your business is removed.

I’ve managed payroll for organisations with hundreds of employees and have seen the impact that getting payroll wrong can have on staff morale. Thankfully by using the right software, with professionally trained staff and the right approval processes in place, payroll can go from being a nightmare to being a sweet dream.

Time

Keeping on top of payroll legislation changes, alongside the other hats that you are wearing when you are running your business is a lot for one person to keep up with.

Every time there is a new starter or a leaver or a pay rise or overtime or sick leave or any other change, you have to keep track of it and make sure it is processed correctly.

Generally when you outsource your payroll it will be done faster. Our specialist team follows a smooth process working to an efficient timetable. Clients who do their own payroll typically find it takes them a lot of time, partly because they are distracted by other parts of running the business.

Put simply, the time you are spending running your payroll is all time that you should be spending on running your business.

Cost

If you are running your payroll in house you have the cost of the payroll software, possibly the cost of training to stay up to date and of course the cost of your time.

A common assumption is that outsourcing that expertise will be expensive. Our payroll services are a great bolt on to our other services at just £5 per person with a minimum charge of £25.

Business continuity

One client recently moved their payroll and bookkeeping to us for business continuity. They saw the risk of having a single point of failure, with all of their finance functions resting with one person in their staff team. What would happen if that person left or if that person was ill at a critical time of the month?

By outsourcing they have refocused that staff member’s time and have saved themselves from the risk of relying on just one person. They have also gained a flexible solution, as our services (and therefore prices) can flex up and down depending on the number of people on payroll each month.

But what about the loss of control?

It’s not uncommon that business owners fear a loss of control when they outsource payroll. I’d suggest the opposite can be true, by outsourcing you can have better control. You are relying on an expert team to do the fiddly difficult bits but you keep control.

We’ll give you a clear timetable for the year ahead with your deadlines and our deadlines. Each month you’ll tell us about any changes to payroll, we’ll process it and then you’ll approve the payroll before we finalise it.

By stepping away from the detail of processing and instead reviewing reports once payroll is processed you will go from the detail to the big picture. You will be able to see the wood without focusing on the individual trees. No loss of control, just a better overview and less stress.

The solution?

As Xero certified payroll advisers our team at Contando have to do regular training throughout the year to keep up to date and to keep our certification.

Xero supports timesheet entries and approvals which integrate with the software, meaning you can be confident that if timesheets are submitted and approved by a manager, staff will be paid accurately and on time.

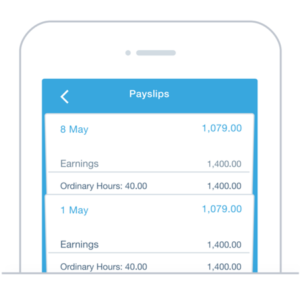

There’s an app which makes it easy for employees to view their payslips, submit their timesheets and apply for leave.

We’ll submit payroll data directly from Xero to HMRC, on time, keeping your business compliant with HMRC.

You have enough to do running your business. With Contando running your payroll it’s one less thing you need to worry about, so you can get back to sleeping soundly, knowing that you are in safe hands.