Does your VAT liability match your VAT return?

Have you ever checked if your VAT liability in your balance sheet is correct?

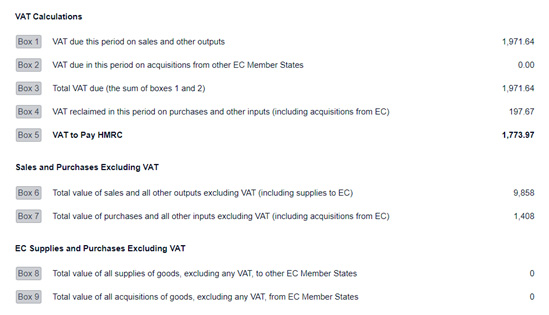

Box 5 of your VAT return shows the amount that you owe to HMRC, or that HMRC owe back to you. In the example from our Demo company this is £1,773.97.

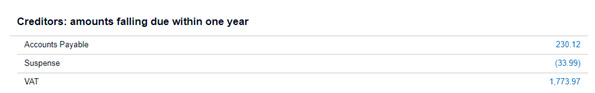

Therefore the amount in the VAT liability code for the Demo company at the same date should also be £1,773.97.

Thankfully for our Demo company it all matches as it should. But what should you do if it doesn’t?

Don’t forget that some organizations will have more than just the current quarter’s VAT return outstanding on the balance sheet if they took advantage of the option to defer VAT payments due to Covid-19 in 2020. In this case the amount on the balance sheet at the date of the last VAT return should be the latest box 5 figure + the box 5 figure from the deferred VAT quarter minus any instalments paid.

Assuming that your VAT returns are quarterly, work back quarter by quarter checking the value on the balance sheet and comparing it to the value in box 5 of the VAT return to find out when it last matched. Now you know when something went wrong even if you don’t know yet what went wrong. At least you know which time period you are looking in.

Have a look for any unusual transactions recorded, have there been any journals posted to the VAT control account? Is there anything else odd standing out? Do you have ecommerce or POS systems integrating with Xero, if so there might be something wrong in the settings when the data is being sent over to Xero.

It could be any one of a hundred different things. Whatever the cause, it’s always best to stay on top of these your reconciliations throughout the year rather than waiting for a nasty surprise at the end of the year, we’d recommend reconciling the VAT control account at least quarterly.