What is a bank reconciliation and why is it important?

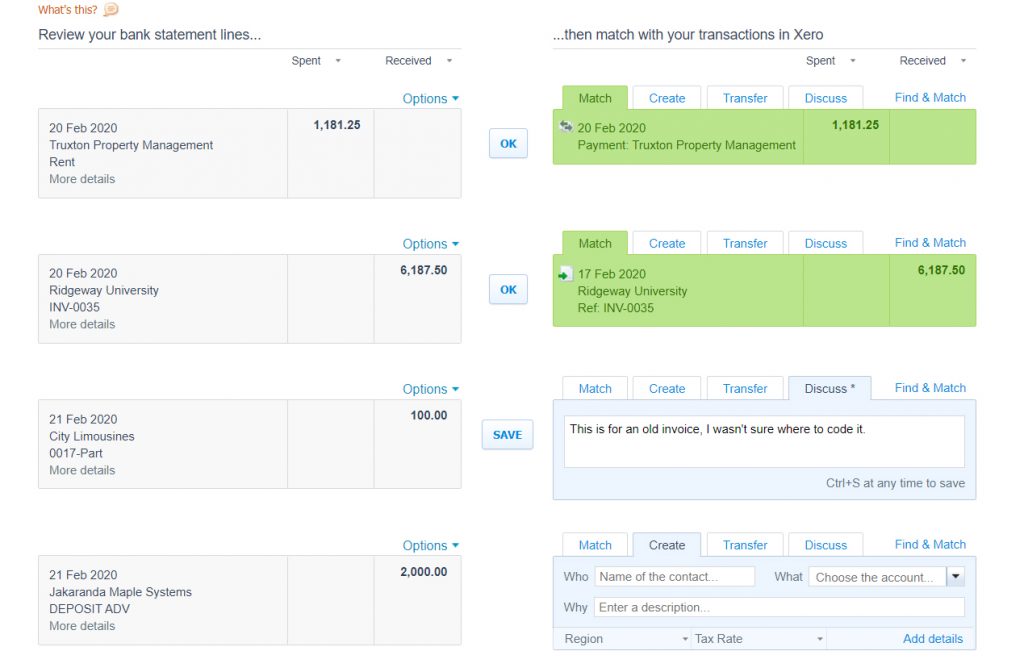

When you reconcile your bank account you compare the transactions in your Xero file against your bank statement. A regular reconciliation helps you to identify any unusual transactions that might be caused by fraud or accounting errors, and this habit can help you to spot inefficiencies.

The key words are accuracy and completeness: a bank reconciliation ensures the completeness and accuracy of transactions in your Xero file.

With Xero bank feeds your bank statement lines will load into Xero ready for reconciliation within Xero. It’s then a game of spot the difference or snap, trying to match the bank statement lines against the transactions you have recorded in Xero.

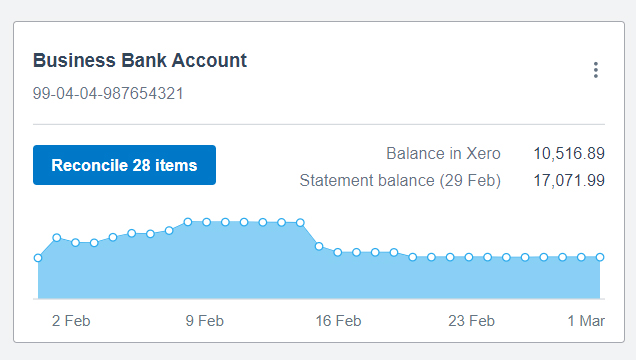

You need to check that your bank statements show an ending account balance that agrees with your Xero balance. If the amounts don’t match, you need an explanation for the difference.

What if something doesn’t match?

It’s normal to see differences due to timing, for example there can be items that haven’t yet cleared the bank, but you should be able to easily explain those differences. This could happen if you write a cheque to a supplier and reduce your account balance on Xero, but your bank shows a higher balance until the cheque clears your account.

Similarly an electronic payment might clear your account a day before or after the end of the month, and you might have expected to see it in a different month. When you can easily account for discrepancies, there’s probably no need to worry.

Reduce fraud risk

A regular review of your accounts can help you identify problems before they get out of hand.

Signs of fraud should be your priority when reconciling transactions in your bank account.

- Were legitimate cheques that you issued duplicated or changed, resulting in more money leaving your account?

- Were cheques issued without authorization?

- Are there unauthorized transfers out of the account, or did anybody make unauthorized cash withdrawals?

- Does the account have any missing deposits?

Identify missing transactions or errors

During the bank reconciliation you may identify missing transactions in your Xero file. These could be transactions such as bank interest for which you don’t receive an invoice to prompt you to record the transaction. Or it could identify transactions for which you should have received an invoice such as payments taken by direct debit. If these transactions are genuine and not fraudulent then now is the time to record them so you can match them. At the same time you should look at your processes so that next month these transactions aren’t missing when you come to do the bank reconciliation.

Occasionally even banks make errors so don’t assume that everything on your bank statement is correct, if there are transactions you don’t recognise then you should be questioning them now.

When should I reconcile?

It’s wise to review your accounts at least monthly. For high-volume businesses or situations with a higher risk of fraud, you may need to reconcile your bank transactions even more often.

It’s certainly a good idea to reconcile before you chase customers for debt. You should allocate any customer receipts at the same time. You want to be sure that the customer hasn’t already paid you before you chase them.

Remember that bank reconciliation is always included in our bookkeeping packages.