How to design a good chart of accounts

In 2018 I presented a version of this blog at the Charity Finance Group Annual Conference to a room of a couple of hundred accountants. This followed my experience of designing and implementing a new chart of accounts for a national charity with £25m annual income. The lessons are just as relevant for organisations of all shapes and sizes. This is more of a series of questions for you to think about rather than a prescribed format that I can give you as it’s not a case of one size fits all.

A significant factor when I presented at the CFG conference was the scope of the project. In my experience with multiple decision makers and different assumptions it was hugely important to define and document the scope of the project – was it just about the finance system or were we changing the feeder systems too? Were we making performance upgrades to the finance system or just changing the coding structure? In a smaller organisation with fewer competing interests this may not be such a significant risk. I would however recommend at least some basic documentation so that you are clear on what you are trying to achieve and what needs to be achieved by when to make it happen.

Define the problem

I presume you wouldn’t want the hassle of changing your chart of accounts if there wasn’t a problem you needed to solve. So take some time to understand that problem. What is currently not working? What could be improved?

Think about your existing reports. What do you wish you had more detailed information about and what could you usefully group together to make life simpler?

Think about the drivers for your business and the information that you need to make decisions.

Time invested now in thinking and planning will pay off.

What do you want to get out?

Every organisation is unique, what you need to know to run your business well won’t be what another business owner needs to know.

Think about the audience. Do you need specific information out of your finance system?

Do you need to report to investors? Who are the decision makers?

Is it useful for you to know how much of your income comes from product sales and how much from shipping charges? If so then have two account codes. If not then don’t create unnecessary complications. Will splitting printing costs, stationery costs and telephone costs into separate categories help you to understand your business and make decisions? If so then create three account codes. If not then leave them grouped together.

What can the software do?

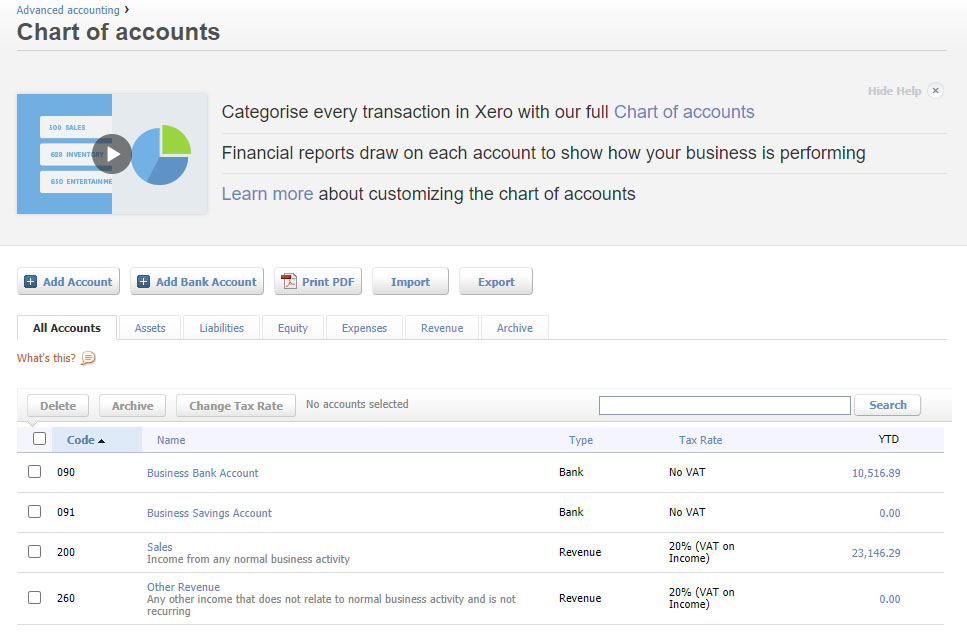

Before getting carried away with all sorts of fancy schemes and grand ideas you are of course restricted by the capability of your accounting system. You can only get out what you can put in. Xero allows you to create a set of account codes plus two tracking categories. This can help you to slice and dice your data to get useful insights from it.

A typical set up would be to have account codes for the different types of costs that your business has: stationery, rent, salaries, telephone, website costs etc.

Your tracking categories can then be whatever is useful to you. This all depends on how your business is structured. If you have a sales department and a marketing department and a warehouse team then you might want to use a tracking category to split your costs (salaries or stationery for example) between each of those departments. Now you can not only get a profit and loss report for the whole business but you can also get an individual profit and loss report for each department.

If each department prepares a separate budget then you can load this budget into Xero and start to report actuals vs budget for each department each month and suddenly you have visibility about how each area of the business is really performing.

Or perhaps for your business it’s useful to analyse income and costs between different locations, either individual branches or perhaps regions (Counties or North, South, East and West). Your second tracking category could be region.

Or a charity dealing with restricted funding may find it useful to use one of the tracking categories to track restricted vs general funds.

Future proofing

A really simple but incredibly practical step you can take is to group your chart of accounts into similar types and to leave room to add new codes in future in a logical place in the structure. For example you could have all staff costs starting with a 4, all premises costs with a 5 and so on.

If your account codes are all three digits then you have room to add in new codes. For example perhaps in future you outsource office cleaning so that you need a new cleaning code and you want it in the same range as the other premises costs. If you use three digits for your account codes you have 100 numbers that start with a 5, if you just used two digits then you would only have 10 numbers to choose from.

Integrations

What other systems does your Xero integrate with? If you change the coding in Xero then what will the impact be? For every organisation it will be a different answer. There are some common systems to think about.

- Payroll

- Your online store feeding into Xero

- Your payment provider, Stripe, Paypal or others feeding into Xero

- Hubdoc feeding into Xero for your bills

- Reporting systems feeding out of Xero

Your project plan should include any updates required to these systems as well as to Xero itself.

Plan when to implement

When I did this for a national charity we started the design and planning a year ahead of the change. Probably for a small business you won’t need such a long lead in time, partly because there will be fewer decision makers and probably there will be fewer and less complex integrations with other systems. Even so, I wouldn’t recommend doing it in a hurry. Take the time to plan it and then rethink it and be confident that the change will give you your desired result. No one wants to waste time making a change only to find that they aren’t reaping the benefits they had hoped for.

It’s absolutely best to make the change at the start of a financial year so that you have a full set of data with this coding structure. Ideally you will want to have your new coding structure in place ready for creating the budget so that you are budgeting on the same basis as you will be recording your actuals. This means that during the year you’ll be able to get out meaningful reports comparing budget to actual.

Once you have designed your new chart of accounts do you also need to create new report templates in Xero? If so then plan in when you will do this or if you are going to get professional support to do this then factor in the lead time and availability of your Xero consultant.

Maintaining history

Do you just want to start fresh in the new financial year or do you also want to recode past transactions so that you can compare the new year to the old year?

If you do want to recode old transactions then of course it creates a bit more work and needs to be factored into your project plan. But the benefit of being able to report this year vs last year could be worth that extra work. And there are ways to bulk recode old transactions in Xero, you don’t need to go back and edit them all one by one!