Clearing accounts

A clearing account can be useful for situations where you have high volumes of income which gets collected together and paid into your main bank account as one lump. If you set it up correctly then using a clearing account will make managing your bank reconciliation and accounting simpler.

Typically it can be useful for card payments coming in via Stripe, Zettle, Paypal or for direct debit collections.

That might be clearer with an example.

Let’s start with understanding the problem

Perhaps you use Stripe or Zettle to collect card payments. Maybe you get 150 payments coming in each month and the pay outs to your main bank happen once a week. The amount paid out to your bank is net of the Stripe or Zettle fees.

Now let’s look at that example with some simple numbers.

If those payments from your customers are £20 each but the fees charged to you are 25p each time then there will be £2,962.50 paid into your bank, that’s gross income of £3,000 (150 x £20) and fees of £37.50 (25p x 150).

But it’s paid out in weekly lumps and your accounts are done monthly, so the time periods don’t align. And out of those lumps paid into your bank account each week you need to be able to split it up and allocate it to the various invoices that are being paid so you know who has paid and who still needs chasing. And you need to record the gross income (£3000) and your fees (£37.50) separately. Oh, and you need to be sure that the payment provider has paid out the right amount (I have seen them make errors with this).

This is where a clearing account can help.

So how does it work?

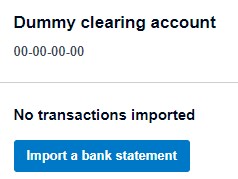

You set up the account code in your accounting system (in our case Xero) like it’s another bank account. We’ll imagine that you take payments via Stripe.

In your Stripe clearing account you will see all of the £20 payments coming in, and all of the 25p transactions going out. Just like a bank account with money coming in and out.

The pay outs to your main bank account will display in the Stripe clearing account as money going out. Because its money going OUT from Stripe and IN to your main bank account. And you’ll be able to see the balance. The balance will be how much money is still sitting in Stripe waiting to be paid out to your main bank account.

Think of it like a mini bank statement.

Now you’ll be able to :

- Match the individual payments received to the invoices that they are paying. This should be easy to do because you can see the receipts coming in one by one.

- You’ll be able to account for the fees because you can see them as separate transactions. And if you use Xero you can set up a bank rule to automatically code them for you.

- You can record transactions in the right period because you’re working with the individual Stripe transactions and not just the weekly pay outs.

This doesn’t just work for Stripe, the same concept applies with Zettle. However, at the time of writing there is an issue with the feed from Zettle to Xero.

It also works well for Paypal transactions, you can treat your Paypal account as another bank account which pays out amounts in lump sums to your main bank account.

We use a clearing account for managing direct debit collections for clients too. We load a file with all of the collections into the clearing account and then when we see the pay out into the main bank account we can check that the “direct debit clearing account” balance has gone down to zero. In this case all of the direct debit collections should be paid out in full so the account should always return to a NIL balance after the pay out. Occasionally it hasn’t, and this is where the clearing account mechanism is a useful check that everything is working as it should.

So, if you have been getting frustrated with managing your income transactions, maybe a clearing account can help.