Support for employers (update 9th Sept 2020)

JSS Open – Employers facing decreased demand

This scheme has now changed compared with the original one below of the 24th of September 2020:

- Employees now only need to work 20% of their usual hours.

- Employees will receive 66.67% of their normal pay for hours not worked

- For every hour not worked the employer now only needs to pay 5%, up to a maximum of £125 per month. Employers can choose to pay more if they wish.

- The government will fund 61.67% for hours not worked up to a maximum of £1,541.75

- Employees will therefore receive at least 73% of normal wages for working a minimum of 20% of their hours where they earn £3,125 per month or less.

JSS Closed – For employers who are legally required to close their premises

We previously wrote about this here and the details of this scheme have not changed.

Support for employers

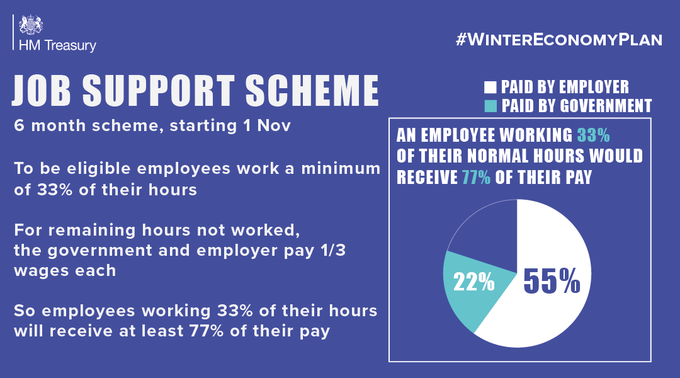

On Thursday 24 September 2020 the Chancellor of the Exchequer Rishi Sunak presented the Winter Economy Plan to Parliament.

The summary below is based on what we know at 25/09/20

https://www.gov.uk/government/topical-events/winter-economic-plan

What is the Job Support Scheme?

It is a new support scheme that will replace the Coronavirus Job Retention Scheme (furlough scheme) – currently due to come to an end on 31 October 2020.

Employees will need to work a minimum of 33% of their usual hours. For every hour not worked the employer and the government will each pay one third of the employee’s usual pay, and the government contribution will be capped at £697.92 per month.

Employees will be able to cycle on and off the scheme and do not have to be working the same pattern each month, but each short-time working arrangement must cover a minimum period of seven days.

Employees using the scheme will receive at least 77% of their pay, where the government contribution has not been capped.

How long does it last?

The scheme will run for 6 months from 1 November 2020.

How do I claim?

Employers will be able to make a claim online through Gov.uk from December 2020.

Which businesses are eligible?

The scheme is open to all employers with a UK bank account and a UK PAYE scheme.

All Small and Medium-Sized Enterprises (SMEs) will be eligible; large businesses will be required to demonstrate that their business has been adversely affected by COVID-19, and the government expects that large employers will not be making capital distributions (such as dividends), while using the scheme.

Employees must be on an employer’s PAYE payroll on or before 23 September 2020. This means a Real Time Information (RTI) submission notifying payment to that employee to HMRC must have been made on or before 23 September 2020.

When will I receive the grant?

Grants will be payable in arrears, this means that for each pay period a claim can only be submitted after payment has been made to the employee and after that payment has been reported to HMRC via an RTI return.

Does the grant cover Employer’s NI and pension?

The grant will not cover Class 1 employer NICs or pension contributions, although these contributions will remain payable by the employer.

Can I use the Job Support Scheme if I didn’t use the furlough scheme?

The Job Support Scheme will be open to businesses across the UK even if they have not previously used the furlough scheme

Can my business claim both for the Job Support Scheme and the Job Retention Bonus?

Yes. It is designed to sit alongside the Job Retention Bonus. Employers will be able to use the Job Support Scheme in addition to claiming the Job Retention Bonus.

The Job Retention Bonus is a £1,000 bonus paid to businesses for each employee brought back from furlough leave (the previous Coronavirus Job Retention Scheme). To claim the employee must remain in continuous employment with the employer until at least January 2021, and be paid at least £520 on average in each month from November to January.

Can staff be made redundant?

Employees cannot be made redundant or put on notice of redundancy during the period that their employer is claiming the grant for that employee. We’re waiting for further guidance but it seems that employees can be moved out of the scheme in order to be made redundant.

Do my staff have to agree to this?

Employers must agree the new short-time working arrangements with their staff, make any changes to the employment contract by agreement, and notify the employee in writing. This agreement must be made available to HMRC on request.