Government Gateway account

If you’re not sure what a Government Gateway account is or why you need one then you are in the right place. I’ll talk you through what it is, how to get one and how to add the services you need to the account.

What is a Government Gateway account and why do I need one?

You need a Government Gateway account to access online services. Once you’ve registered, you can sign in for things like your business tax account, Corporation Tax, PAYE for employers and VAT.

You’ll be able to view things like your PAYE liabilities, your VAT certificate and your VAT liabilities online.

How to get a Government Gateway account

If you’re not sure if you had an account in the past you can try the options:

- I have forgotten my password

- I have forgotten my Government Gateway user ID

- I have forgotten my Government Gateway user ID and password

If you have never accessed these services online then the first thing you need to do is the register for an account.

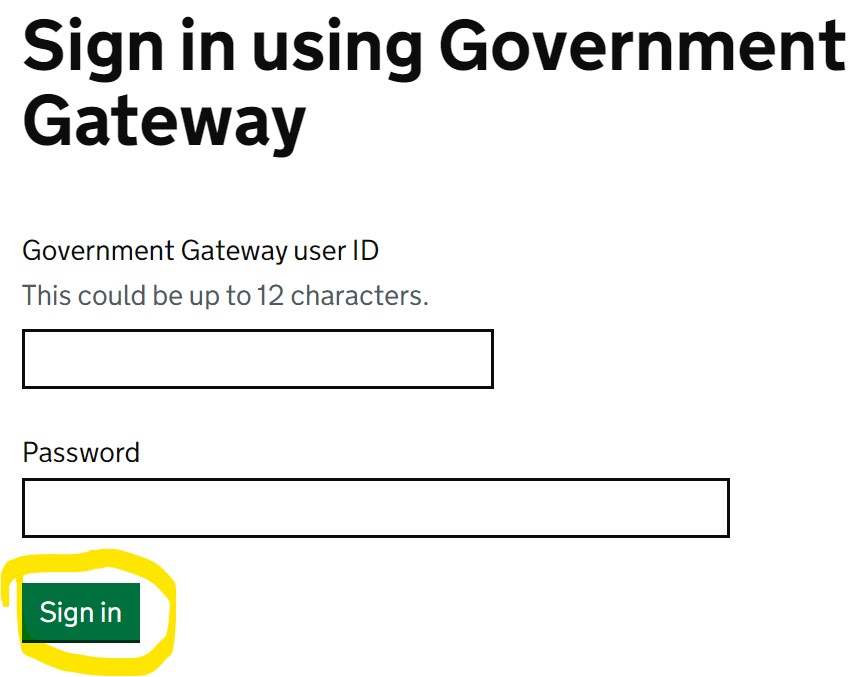

Simply go to https://www.access.service.gov.uk/login/signin/creds and select “Create sign in details”. Enter your email address and HMRC will email a confirmation code to you. Enter the confirmation code and then you will be given a User ID for your Government Gateway account.

You have now created you Government Gateway account.

Tip: It’s best to register for one Government Gateway account per organization. You don’t need a separate account for each type of tax, if you register separately for PAYE and for VAT for example you’ll just have more login details to remember!

Tip: Save the User ID somewhere safe, maybe print it to PDF, because if you are anything like me you won’t be able to remember a 12 digit code to login and nobody wants the stress of forgetting the code.

How do I use the Government Gateway?

Now that you have an account you need to add the relevant taxes for your organisation to your account so that you can view the details online. The taxes you need to add will depend on the nature of your organisation but typically you might want to add:

- PAYE for employers

- VAT

- Corporation Tax

This isn’t the same as registering for these services in the first place. If your organisation isn’t registered as an employer and you therefore don’t have PAYE references then you won’t be able to add PAYE to your account, you’ll have to register for PAYE first.

To add the taxes simply follow these steps:

From the Business Tax Summary page click on “get online access to a tax, duty or scheme”. Pick the tax that you want to add. Click the “continue” button. You will need to enter the relevant information for that tax so make sure you have it available, this could be the PAYE reference numbers or the UTR (Unique Taxpayer Reference) for Corporation Tax.

Once you’ve done this HMRC will send an activation code in the post to the registered address. Once this arrives just enter the code into your account and the tax should be active in your account.

Now you should be up and running and able to view things like your PAYE and VAT liabilities and VAT certificate online.

Tip: As the code can take a week or more to arrive it’s best to register early and not the day before a deadline!