What should an invoice include?

Do you know what info you need to include on an invoice?

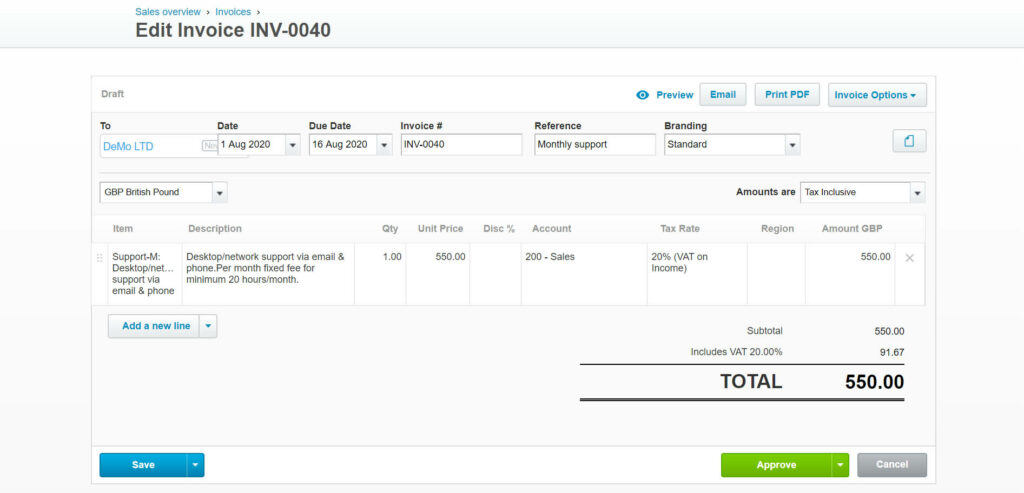

Your invoice must include:

- a unique identification number

- your company name, address and contact information

- the company name and address of the customer you’re invoicing

- a clear description of what you’re charging for

- the date the goods or service were provided (supply date)

- the date of the invoice

- the amount(s) being charged

- VAT amount if applicable

- the total amount owed

Limited company invoices

If your company is a limited company, you must include the full company name as it appears on the certificate of incorporation.

If you decide to put names of your directors on your invoices, you must include the names of all directors.

VAT invoices

You must use VAT invoices if you and your customer are VAT registered.

These include more information than non-VAT invoices.

Whether you are a sole trader, a limited company, VAT registered or not, Contando can help you to get Xero properly set up so that your invoicing is legally compliant and simple. So you can spend more time making sales and less time worrying about invoicing rules.

VAT invoice requirements:

If your company is registered for VAT then you generally need to be issuing compliant VAT invoices. There are a few exceptions. You don’t need to issue a VAT invoice if;

- your invoice is only for exempt or zero-rated sales within the UK

- you’re giving goods as a gift

- you sell goods under a VAT second-hand margin scheme

- your customer operates a self-billing arrangement

These situations are the exception and not the norm.

Assuming none of these exceptions apply then what are the requirements?

There are specific rules for retail invoices (more on that later) but if you are not making retail supplies then the minimum information that you must include on a invoice depends on the value of the invoice;

For supplies under £250 you can issue a simplified invoice. This must show;

- A unique invoice number that follows on from the last invoice

- Your business name and address

- Your VAT number

- The tax point (or ‘time of supply’) if this is different from the invoice date

- Description of the goods or services

- Rate of VAT charged per item – if an item is exempt or zero-rated make clear no VAT on these items. (If items are charged at different VAT rates, then show this for each.)

- Total amount including VAT (If items are charged at different VAT rates, then show this for each.)

Otherwise you need to issue a Full invoice. This must show all of the above plus;

- Date

- Customer’s name or trading name, and address

- Total amount excluding VAT

- Total amount of VAT

- Price per item, excluding VAT

- Quantity of each type of item

- Rate of any discount per item

- But… you don’t need to show the total amount including VAT

Xero makes customer invoicing easy peasy. Our team at Contando are experts at getting Xero set up efficiently for you. Why waste time worrying about VAT compliance when you have a team on hand here ready to help you?

What if I am a retailer?

The rules for retail invoices are different.

There’s no requirement to issue a VAT invoice for retail supplies to unregistered businesses. As a retailer, you may assume that no VAT invoice is required unless your customer asks for one. If you’re asked for an invoice then you have the following options depending on the value of the charge for the individual supply.

If the charge you make for the individual supply is:

- £250 or less (including VAT), then you can issue a simplified invoice as above; showing your name, address and VAT registration number, the time of supply (tax point), a description which identifies the goods or services supplied, and for each VAT rate applicable, the total amount payable, including VAT shown in sterling and the VAT rate charged – exempt supplies must not be included in this type of VAT invoice

- more than £250 and you’re asked for a VAT invoice, then you must issue either a full VAT invoice or a modified VAT invoice, showing VAT inclusive rather than VAT exclusive values

There are some great point of sale apps that integrate with Xero to make running your retail business easier. Here at Contando we are experts at app implementation. We’re geeky kids who get a kick out of reducing your admin headaches and saving you time, because no one got into business because they enjoy financial admin – apart from us!

If you want to find out how we could help you then do get in touch.

P.s. There’s a full summary table comparing the vat invoice requirements below;

| Invoice information | Full invoice | Simplified invoice | Modified invoice |

| Unique invoice number that follows on from the last invoice | Yes | Yes | Yes |

| Your business name and address | Yes | Yes | Yes |

| Your VAT number | Yes | Yes | Yes |

| Date | Yes | No | Yes |

| The tax point (or ‘time of supply’) if this is different from the invoice date | Yes | Yes | Yes |

| Customer’s name or trading name, and address | Yes | No | Yes |

| Description of the goods or services | Yes | Yes | Yes |

| Total amount excluding VAT | Yes | No | Yes |

| Total amount of VAT | Yes | No | Yes |

| Price per item, excluding VAT | Yes | No | Yes |

| Quantity of each type of item | Yes | No | Yes |

| Rate of any discount per item | Yes | No | Yes |

| Rate of VAT charged per item – if an item is exempt or zero-rated make clear no VAT on these items | Yes | Yes (1) | Yes |

| Total amount including VAT | No | Yes (1) | Yes |

(1) If items are charged at different VAT rates, then show this for each.