Remove & redo vs unreconcile

Xero’s bank rec is great, the auto matching helps to make the bank rec quicker and easier. It’s also deceptively simple.

I say deceptively because I’ve lost count of the number of Xero bank reconciliations I’ve seen that initially look clean because all of the bank statement lines are reconciled, but when I run the bank reconciliation report it’s a different picture. This is because of unreconciled account transactions.

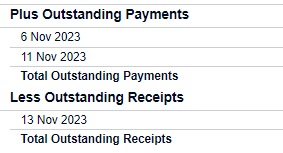

In your bank reconciliation report they will be headed “Outstanding Payments” and “Outstanding Receipts” like this:

The Outstanding Payments and Outstanding Receipts represent payments and receipts that you have told Xero have happened, but that haven’t been matched to a bank statement line.

If you don’t know how to view the bank reconciliation report then have a look at the top right of the bank rec screen and you should see a link.

How does this happen?

There are a few ways this can happen but for today I’m focusing on “Unreconciled” vs “Remove & redo”.

It’s quite easy to be merrily clicking “OK” to reconcile transactions and realise you’ve reconciled something you shouldn’t have, so you need to undo it.

If you navigate to the payment transaction and click on options you will see two options, Unreconcile, and Remove & Redo:

(Don’t worry, this is a screen shot from my Demo company, I haven’t shared anyone’s bank details here!)

The difference between the two options is what makes the difference.

If you remove and redo you are removing the payment transaction and because there is no payment transaction it can’t be matched to the bank statement line, so the bank statement line is unreconciled and is released and free to be reconciled against a different transaction. The crucial bit in there is that you are removing the payment transaction.

If you just unreconcile then you are not removing the payment transaction. All you are doing is breaking the link between the payment transaction and the bank statement transaction. It can look the same to the untrained eye. The bank statement line is still unreconciled and released and free to be reconciled against a different transaction, just like in the first scenario. So what’s different? The crucial bit here is that the payment transaction still lives. It still lurks in the background, it’s just that you’ve cut the thread connecting it to that bank statement line. But it’s still there. If it was a payment of a bill then that bill will show as paid and not as due, even though it’s not matched to a bank statement line. The payment transaction will show up in the bank reconciliation report under Outstanding Payments.

So what’s the point?

Be careful about when you use “Remove & redo” and when you use “Unreconcile”.

As a safety net, run the bank reconciliation report periodically to check for lurking account transactions that aren’t matched to a bank statement line.

How do I fix it?

If you have identified rogue lurking account transactions it’s easy to make things even worse by trying to fix it, so pay attention here.

If you click through from your bank reconciliation into the Outstanding Payment transaction you’ll see something like this. Notice in the top left corner it says “Unreconciled”.

If you click into options you can “Mark as Reconciled” or “Remove & Redo”. I can’t cover every possible scenario here, but most of the time you will want to click into “Remove & Redo”. Like we saw above, this remove the payment transaction.

By selecting “Mark as Reconciled” what you will do it create a bank statement line, so then the bank transactions in Xero won’t match the actual bank statement. There are rare occasions when you will want to select this option. If there has been a hiccup in the bank feed and that bank statement line is missing and you need to create it, then this is a way to do it. But generally, avoid the “Mark as Reconciled” option.